Australian framework for the valuation of public sector collections for general purpose financial reporting

Acknowledgements

The Council of Australasian Museum Directors (CAMD) acknowledges and expresses its appreciation to the following people who provided their time on a voluntary basis in drafting and/or reviewing early versions of this document:

- Cameron Dunsford, Managing Principal from RHAS/AON and Rodney Hyman, Managing Principal, RHAS/Aon who, along with their staff, contributed their specialist expertise in sampling and valuation methodologies.

- Sean Rugers, Partner, PwC.

- Michael Blake, former Auditor-General of Tasmania, Member AASB and IPSASB

CAMD wishes to thank its members for their commitment and genuine collaboration that allowed this project to be delivered. CAMD acknowledges the CFOs and senior financial and curatorial staff of member institutions and, in particular, Cameron Slatyer, Branch Manager, Life and Geosciences, Australian Museum, John Buttle, Acting Director, Corporate Resources and CFO, Australian Museum and Stephen Forbes, Executive Officer, CAMD.

CAMD also expresses its appreciation to the following organisations which contributed by way of review and feedback to assist in the finalisation of the framework:

- Chartered Accountants Australia & New Zealand

- CPA Australia

- Heads of Treasuries Accounting and Reporting Advisory Committee

- Jones Lang Lasalle

- Statistical Consulting Centre, University of Melbourne

CAMD expressly accepts sole responsibility for the form and content of this framework.

Definitions

In this Framework:

Accession: means the procedure for cataloguing an object as a Collection Asset. The process usually involves the allocation of a unique registration number to an Asset and recording details of the Asset in a collection management database.

Census: means a survey conducted on the full set of assets or items belonging to a given population. A census is the complete enumeration (a complete count) of a population or group at a point in time.

CITES: means the ‘Convention on International Trade in Endangered Species of Wild Flora and Fauna’. It is an international agreement between governments. Its aim is to ensure that international trade in specimens of wild animals and plants does not threaten their survival.

Collection(s) and Collection Asset(s) (also referred to as Heritage and Cultural Assets): means those objects, including cultural objects (historical, art work, social or cultural objects), and natural objects (biological and geological objects), which also include digital and multimedia assets, that are intended to be held in trust and for the benefit of the public because of their historical, cultural and scientific significance and/or rarity. This definition excludes living assets such as botanic gardens or heritage assets such as significant trees, natural landscapes or heritage buildings.

As public assets, Collections and Collection Assets have restrictions on use. Objects added to public collections are intended to be held in perpetuity. There are strict controls over exchange, disposal or sale.

Collections are treated as non-current physical assets for the purposes of public sector financial reporting. Exclusions may apply to sensitive Collection Assets (for example, human remains; secret sacred objects; CITES objects acquired from a legal seizure, culturally sensitive assets), where the Museum determines that it is unable to measure value reliably and/or it is inappropriate to value.

Collections Managers or Curators: means personnel designated with responsibility for the development/expansion, management and protection of Collections held at Museums on behalf of the public.

Digital Asset: is any text or media that is formatted into a binary source and includes the right to use it; digital files that do not include this right are not considered digital assets. Digital assets are categorised into images and multimedia, called media assets, and textual content.

Donations: means the transfer of custody and title of objects from an external party to a Museum, including through the Australian Government Cultural Gifts Program. No considerations are paid.

Fair Value: means the price that would be received to sell an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date, as defined in Australian Accounting Standard AASB 13 Fair Value Measurement and taking into account highest and best use.

Highest and Best Use for Collection Assets takes into account the use of the asset that is physically possible, legally permissible and financially feasible as defined in the Australian Accounting Standard AASB 13 Fair Value Measurement. For all assets valued for financial reporting in Australia, key considerations include whether an asset is able to transact within an identified market i.e. the local or international art market, or whether it is more appropriately considered in terms of cost of replacement; and whether an individual collection object reaches its highest and best value when considered as part of a collection or as an individual object. Restrictions may limit the highest and best use that can be applied, particularly in the case of Australian legislation, sensitive Collection Assets (for example, human remains; secret sacred objects; CITES objects acquired from a legal seizure, culturally sensitive assets).

Level 1, Level 2 and Level 3 inputs: means the hierarchy of observable and unobservable inputs used for measuring value, as defined in the Australian Accounting Standard AASB 13 Fair Value Measurement.

Museum: means a not-for-profit public sector institution, association, trust, government agency or other incorporated organisation that is responsible for the management of Collections on behalf of the public.

Relative Standard Error (‘RSE’): the extent to which a sample estimate is likely to deviate from the true population. The RSE is the standard error expressed as a fraction of the estimate (i.e. expressed as a percentage).

Replacement Value: equivalent to the cost approach defined in AASB 13, which reflects the amount that would be required currently to replace the service capacity of an asset (often referred to as current replacement cost). For Museum collections this means the costs associated with acquiring another Collection Asset (often the cost of recollection) of equivalent value to the institution, where that value comprises historical, cultural and scientific significance and/or rarity.

Restrictions on use: as public assets, Collections and Collection Assets have restrictions on use. Objects added to public collections are intended to be added in perpetuity. There are strict controls over exchange, disposal or sale, normally subject to separate or external scrutiny such as a Board or Trust. State, Territory or Commonwealth institutions also operate under statutory controls established by Act of Parliament.

Type Specimens: Collection Assets found in certain types of collections, particularly biological, geological and some archaeological collections. A Type Specimen is the reference point for a particular class of objects, identical in intent to the master set of weights and measures held by most countries.

Uncatalogued Objects: means objects that are part of the Collection, but which have not been formally catalogued or put into a database. Generally, objects are assessed and processed before being added to the Collection.

1. Introduction

At the 2016 Council of Australasian Museum Directors (CAMD) Annual General Meeting, members discussed the shared challenges that Museums face in measuring the value of Collections for general purpose financial reporting. Although Australian Museums vary in terms of their Collection management procedures and the types and numbers of Collection Assets in their care, members identified a number of characteristics that make valuation of Collections unlike other non-current assets:

- Museums have a unique role in the management, development and safeguarding of Collections for the benefit of future generations. The intent of Museums is to ensure that Collection Assets are preserved indefinitely.

- Collection Assets are acquired for the specific function and purpose of becoming part of the Collection and this represents their best use.

- Museums are in the process digitally documenting and cataloguing all objects within their custody. In some cases, this is a long-term objective due to the number and nature of objects held at Museums. As such, most Museums have in their collections a number of uncatalogued objects.

CAMD members noted that jurisdictions provide financial reporting directions and guidelines that Museums must adhere to when measuring the value of their Collections (refer Attachment A). Each jurisdiction references Australian Accounting Standards AASB 13 Fair Value Measurement and AASB 116: Property, Plant and Equipment. CAMD members considered the similarities and differences between jurisdictional guidance and agreed that a common valuation methodology was possible and would advance the sector’s financial reporting. This Framework also refers to AASB 137 Provisions, Contingent Liabilities and Contingent Assets, AASB 138 Intangible Assets, AASB 1049 Whole of Government and General Government Sector Financial Reporting and AASB 136 Impairment of Assets.

This Framework establishes a best practice methodology for the valuation of Collections at Fair Value. This Framework recognises that there will be nuances in how each Museum applies the methodology but seeks to establish consistency and a high level of comparability of financial reporting across the Australian Museum sector.

2. Valuation Framework

| 2.1 Scope of valuation |

Under this Framework, all non-current physical Collection Assets, including Digital Assets, are within the scope of valuation. This includes Collection Assets that are currently on loan from the Museum to external parties, including long-term loans. Objects that are on-loan to the Museum and in the Museum’s care at the time of the valuation are generally excluded. However, consideration may need to be given to long-term loans of items to/from the Museum whereby the right to use an asset may effectively reside with the custodial institution. |

| 2.2 Principles of Collection valuation |

In general, all assets in a collection have a value defined as fair value through highest and best use. The principles of AASB 13 Fair Value Measurement should be applied including, inter-alia, the “three tier” valuation hierarchy. However, for valuation purposes, collections can generally be separated into three classes summarised below and then discussed in detail hereunder: a) Highly Significant and Sensitive Collection Assets are those objects which because of uniqueness, sensitivity or legal frameworks need to be regarded as priceless or valueless; b) High Value Collection Assets are those where the value of the asset exceeds a predetermined threshold amount; and c) General Collection Assets are those where replacement value represents fair value through highest and best use. |

| 2.3 Highly Significant and Sensitive Collection Assets |

In exceptional situations it will be impossible to place a reliable value on certain Collection Assets. These Assets are likely to be one of the following: a) Unique, irreplaceable (including in terms of their utility) and of significant cultural, social, historical or scientific value, with no data available to determine a market or replacement value; and/or b) Sensitive or legally defined Collection Assets (these include but are not restricted to: human remains; secret sacred objects; and objects acquired from a legal seizure under CITES, where the Museum determines, supported by independent expert evidence, that it is inappropriate to record value and/or there is an inability to reliably measure value. Example: A Museum receives a donation from the State Government of seized wildlife trade items, comprising ivory with a high market value. It is illegal to sell items listed under CITES. Therefore, the institution may choose to identify this material as a Highly Significant and Sensitive Collection Asset. These Assets should be recorded at nil value. As further support to this statement, AASB 13 requires all the characteristics to be taken into account in determining fair value, one of which may relate to restrictions on the asset which could prevent it from transacting. In coming to this conclusion there is an obligation to prove that if an item came on the market it would not be saleable due to cultural or legal restrictions. This decision should be ideally supported by expert opinion, particularly if the recording at nil value is likely to cause a materially different outcome to the Museum’s financial reports. Assets recorded at nil on this basis should be separately disclosed in the financial report. A register of Highly Significant and Sensitive Collection Assets should be maintained by the institution. In the case of secret sacred material, a registration or ID number may be used in lieu of a textual identifier. It is sufficient for Highly Significant and Sensitive Collection Assets to be identified in the institutional collection database as such. |

| 2.4 High Value Collection Assets |

Known High Value Collection Assets are those whose fair value can be estimated in the market and where there is an observable market for like objects within the meaning of AASB 13. For many High Value Collection Assets this will be auction price. Institutions should consider whether an individual Collection Asset reaches its highest and best value when considered as part of a collection or as an individual object. There may be cases where assets have a higher value when considered as part of a collection. Typical High Value Collection Assets may include (but are not restricted to) cultural artefacts, minerals and gemstones, taxidermy animals, rare photographs, furniture or artwork. To be valued as High Value Collection Assets, institutions should establish a threshold value having regard to their own circumstances including the nature, diversity, value profile by category and total value of collections. There are two potential methodologies for establishing a threshold: a) Establishing assets estimated to have a cost or value of more than a predetermined dollar threshold value eg: $10,000 b) Establishing replacement value (defined under 2.6 below) as the threshold and using individual values where the market price is likely to exceed replacement value. This threshold methodology should be disclosed to enable comparison between institutions. Example: A Museum has a rare Soviet-made air defence missile. Despite the item being close to irreplaceable, it does have a market value, which by comparison with recent auction catalogues, is found to be AUD $60,000 (only bid prices are available). This is higher than the Museum’s threshold value for High Value Collection Assets ($10,000) and the item is therefore identified as a High Value Collection Asset. The replacement value is a redundant threshold in this instance as the replacement value is likely to be equivalent to auction price. Institutions should document the methodology for establishing High Value Collection Asset value. AASB 13 requires that an entity need not undertake an exhaustive search of all possible markets to identify the principal market or, in the absence of a principal market, the most advantageous market, but it should take into account all information that is reasonably available. Auction house prices are a relevant reference that are available. AASB 13 indicates that the most representative value within the bid and ask price range is the one that should be used regardless of the category within the fair value hierarchy. Institutions may wish to use professional valuers, but valuers must document the basis of price estimates by referring to auction house prices or equivalent. This is discussed further in section 6. |

| 2.5 Historical Cost |

There may be limited circumstances where institutions consider applying Historical Cost rather than observable market value when determining a value for Collection Assets. The Cultural Gifts Program is an Australian Government program offering tax incentives to encourage people to donate cultural items to public art galleries, museums, libraries and archives in Australia. The value is established based on two expert market valuations. Institutions may wish to use the valuation attributed to Cultural Gifts rather than re-estimating market value. In such situations, historical cost is considered to be a proxy for fair value as it is based on market valuations. However, as the valuations may be for different purposes, the valuation for Cultural Gifts Program purposes may in some instances need to be calibrated in order to determine an appropriate value for the institution’s recording purposes. |

| 2.6 General Collection Assets |

General Collection Assets comprise the balance of most collections and can be defined as assets that can be valued using a cost (replacement value) approach. These include (but are not restricted to) bulk stored materials such as alcohol preserved scientific specimens, archaeological material, material gathered on field work, archival material or cultural material. General Collection Assets can include intangible assets as defined in AASB 138, e.g. digital footage from exploration of a ship-wreck. Consistent with AASB 13, the cost approach for general collection assets should be the minimum that it would cost, in the normal course of business, to replace the existing asset, specific to the entity and collection being valued. This can include the current salary rates, use of volunteers and experts, costs of materials and curation experienced by a Museum in today’s dollar terms. In addition, historical information on donated time, donated collections, expeditions mounted by third parties, vessel use provided by third parties, costs borne by others (e.g. transportation costs contributed by Government), Type Specimens described by external academics and general costs incurred by a Museum or its staff can be taken into account. Example: A Museum has two specimens in its natural history collection of the same species, both collected from the Great Victoria Desert, Western Australia. One is a simple scientific specimen and the other is the type specimen of the species. Both specimens have a value calculated at cost of $185, being the replacement value of visiting the same site to recollect a specimen, including staff time, expedition costs and specimen preparation. The Type Specimen (see definition) also has the cost of scientific description and research added, costing $815. The normal scientific specimen has a value of $185, whereas the Type Specimen is valued at $1000. |

| 2.7 Uncatalogued Objects |

Most Collections will contain a proportion of objects that are part of the Collection which remain uncatalogued. In many instances, this is a reflection of the significant age of the collection, the advent of electronic recording and the availability of in-house resources. In large collections, this can comprise a substantial proportion of the total holdings of an institution. In many institutions this remains a valid, integral part of the collection available for core functions of the institution such as research or exhibition. In most cases uncatalogued objects in a Collection are likely to be organised (e.g. stored on shelves) and have sufficient information available to measure value. Where a Museum can reliably and efficiently measure the number and value of uncatalogued objects, these objects should be included in the Asset portfolio. The valuation is likely to be undertaken using a random sampling technique to determine the total population and the value of the objects (see further details of sampling below – refer 2.9). There are instances where a Museum has unorganised and uncatalogued objects that cannot be stratified (e.g. donations waiting sorting), these will be excluded from the scope of valuation. Although these objects are in the care of the Museum, there is no reliable and verifiable way to determine the number and value of these objects until they have been organised. |

| 2.8 Acquisition and Disposal of Collection Assets |

Upon initial acquisition, Collection Assets should be recorded at cost except that donated assets should be recorded at fair value (usually determined by an independent valuer). Public collections usually hold collections in perpetuity, however there are isolated circumstances in which Collection Assets are disposed by way of destruction or as a result of irrecoverable damage, loss or exchange. Assets that are deaccessioned and disposed of should be writtenoff and disclosed in the financial report. There must be a transparent and accountable deaccession process. The value will be reported as a loss against the institution’s asset base, based on the most recent valuation, consistent with the discussion of exit cost in AASB 13. |

| 2.9 Stratified Random Sampling |

To measure the value of large numbers of Collection Assets (that are not individually of high value), Museums should apply a Stratified Random Sampling technique. This technique recognises the size and nature of Collections and is used to ensure a reliable, efficient and cost-effective valuation process. With guidance from Collection Managers, the Collection portfolio is separated into sub-groups that share similar characteristics and value (‘strata’). A census is then taken of each stratum. A randomly generated sample of Assets is selected from each population for valuation and is fully described (including location details). The valuation is then scaled up to the rest of the population. The Stratified Random Sampling design should be set up so that it is expected to achieve a Relative Standard Error (‘RSE’) of five percent or less in respect of the total Collection Assets to which the sampling technique is applied (as distinct from “subcollections” which may have higher RSEs). The technique should be independently validated (e.g. by a qualified statistician) at each comprehensive valuation. Any Asset suspected of having a value above the Museum’s threshold value during sampling should be separated and valued individually (see 2.4 - High Value Collection Assets). Their influence on the value of the strata population is thereby nullified. The methodology must be disclosed in the financial report. An example of the Stratified Random Sampling technique applied to a Museum’s Collection is provided in Attachment B. |

| 2.10 Relative Standard Error (RSE) |

Relative Standard Error is a measure of variability or uncertainty around an estimate. The RSE is the standard error expressed as a fraction of the estimate (expressed as a percentage). The RSE is a useful measure, particularly for comparison of precision between different categories and data items (i.e. value and number of assets). It also provides an immediate assessment of the relative precision of an estimate. The levels of precision achieved in a sample valuation cannot be predicted with certainty prior to the valuation, so initial sample allocations are based on the listings and the estimated variability in each stratum. Provided this leads to a satisfactory RSE the sample values are projected to estimates of total value within each category. The strata estimates are then calculated by multiplying the total value of the sampled Assets by the ratio of the total number of Assets in that category to the number of Assets valued in the sample. An example of a mathematical formula to determine RSE for single-stage sampling is provided in Attachment C. Other verified formulae are available for museums to use, particularly where they might use multi-staged sampling. |

| 2.11 Valuation unit |

A valuation unit is a logical grouping of similar and related Assets that are treated as a stand-alone Asset for measuring value. (For example, a valuation unit within a natural history collection may be one jar/lot, one tray, or one folder of image files.) A valuation unit applies when it is not reasonable or beneficial to value each Asset as a stand-alone Asset. When establishing valuation units, Museums should consider whether the objects were acquired as a group or individually, the highest and best use of the Assets, and the likely cost of valuing the Assets as a unit versus as individual Assets. |

| 2.12 Measuring Fair Value: Collection Assets with a measurable market value |

A Museum should use valuation techniques that are appropriate to the circumstances, provide sufficient data, and maximise the use of relevant observable inputs such as the market price (Level 1 and 2 inputs). The value of Assets could be measured using the transaction price (where the transaction price equals Fair Value), the expertise of a qualified valuer (including those approved under the Australian Government Cultural Gifts Program), Collections Managers or auction houses, or through comparable sales data, catalogues and online market places. A combination of available data may be required to determine Fair Value. |

| 2.13 Measuring Fair Value: Collection Assets that cannot be measured using market value |

Many objects, particularly scientific, archaeological and anthropological specimens cannot be reliably valued using the market approach because they have no observable market value, therefore the current replacement cost approach is to be used for these Assets. The Museum should estimate how much it would cost to recollect asset(s) (including staffing, permits, equipment, consumables, travel, transportation, documentation, conservation, development and preparation costs). An example of a practical methodology is to delineate defined cost of replacement in categories, e.g. local, regional, remote and international, as the geographical proximity to the Museum of the collecting activity will radically impact on its cost of recollection. A premium for Type Specimens may be required to reflect the greater effort required to delineate these specimens. Where possible, the Museum should use fully costed examples of recent acquisitions to inform the recollection cost. For consistency and efficiency, the Museum should determine an average recollection cost on a per object basis for each category of Asset. Where recollection is not possible, the Museum should consider estimating the cost of reproducing an exact replica of the Asset to the extent possible using the same specifications, design, materials and construction techniques if that approach meets the Museum’s collection development plan. |

3. Valuation cycle |

In recognition of the significant resources (including staffing costs and professional fees) required to undertake a valuation, comprehensive valuations should occur on a five year cycle. The first year would be a comprehensive valuation of the Collection to establish a base valuation (at Fair Value). Comprehensive valuations should be conducted in consultation with qualified Valuers, Collections Managers and a professional statistician to verify sampling and stocktake techniques. In years two, three, four and five, Museums should:

Collection Assets that have incurred substantial expenditure (e.g. conservation costs) may need to be revalued, but as a rule, assets that have already been valued as part of the first year comprehensive valuation are not usually revalued at interim valuations. Interim valuations may be conducted internally by the Museum, with advice from a qualified Valuer and other independent experts as needed.

|

4. Depreciation and Impairment of Collection Assets |

Depreciation is not usually charged on Collections as the intended useful lives of Collections are indefinite and Museums intend to preserve the Assets in perpetuity. While institutions adopt the general principle that they will preserve objects in perpetuity, this is not always going to be the case. Fragile objects will eventually deteriorate beyond use (e.g. some paper records, nitrate negatives) - digitisation provides another format, but the original object has a limited useful life. While there is an intention to hold in perpetuity, the reality is that some assets will have much lower useful lives and should be depreciated. Any assets with finite lives should be subject to depreciation. In addition, assets should be assessed for impairment in accordance with AASB136 Impairment of Assets. |

5. Verification of Collections |

Museums should undertake a stocktake of a proportion of the Collection at each comprehensive valuation using a statistical sampling technique to achieve a 95 percent or higher confidence that all assets included within the scope of a comprehensive valuation are present at the Museum’s facilities or are otherwise correctly documented. The stocktake methodology should be validated (e.g. by a professional statistician). |

6. Documentation of valuations |

At a minimum, the following should be included in the valuation documentation:

|

Attachment A

Legislative and policy context and key accounting concepts

The following key accounting standards and legislation have been considered in the development of this Framework:

- Australian Accounting Standard AASB 13 Fair Value Measurement

- Australian Accounting Standard AASB 116 Property, Plant and Equipment

- Australian Accounting Standard AASB136 Impairment of Assets

- Australian Accounting Standard AASB138 Intangible Assets

- Commonwealth Entities Financial Statements Guide which applies to all Commonwealth reporting entities responsible for preparing financial statements under the Public Governance, Performance and Accountability (PGPA) (Financial Reporting) Rule 2015 (the FRR).

The following lists the Australian State and Territory directions and guidelines relating to the treatment of non-current physical assets with which Museums must adhere. These directions and guidelines are based on the above Australian accounting standards.

- Government of South Australia APF III Asset Accounting Framework (12 May 2015)

- Government of Western Australia Treasurer’s Instruction 954 Revaluation of Non-Current Physical Assets (14 February 2014)

- New South Wales Treasury TPP14-01 Accounting Policy: Valuation of Physical Non-Current Assets at Fair Value – Policy and Guidelines Paper (February 2014, revised June 2014)

- Northern Territory Government Treasurer’s Directions A2 Accounting – Assets (31 March 2006)

- Queensland Government Non-current Asset Policies Tools (3 May 2017)

- Tasmanian Government Treasurer’s Instruction 304 Recording of Non-current Assets (1 July 2005)

- Victoria State Government FRD 103F Non-Financial Physical Assets (1 June 2015)

Attachment B

Stratified random sampling technique – a Practical Example

The excerpt below from a recent collection valuation using a sampling-based approach demonstrates the magnitude of sampling required to reach a Relative Standard Error of less than 2.5%. This example demonstrates that if a collection is carefully categorised, and all high value items isolated and valued individually, the sample sizes, and therefore cost of valuing, becomes manageable for Museums with large collections.

In the excerpt below, only 1.3% of items were sampled.

| Stratum Methodology* | Population size | Sample size | Estimate of Total Stratum Value |

| Random Samples | 405 | 15 | $ 146,192 |

| Random Samples | 92 | 15 | $ 704,843 |

| Random Samples | 13,998. | 50 | $ 5,266,328 |

| Random Samples | 319 | 15 | $ 1,078,220 |

| Random Samples | 78 | 20 | $ 188,503 |

| Random Samples | 125 | 12 | $ 1,259,375 |

| Random Samples & Units | 381 metres | - | $ 1,807,289 |

| Random Samples | 37 | 14 | $ 542,499 |

| Random Samples | 446 | 15 | $ 290,287 |

| Random Samples | 558 | 20 | $ 1,806,246 |

| Random Samples | 138 | 25 | $ 175,130 |

| Random Samples | 2,081 | 15 | $ 1,118,191 |

| Random Samples | 2,238 | 40 | $ 2,811,208 |

| Random Samples | 136 | 20 | $ 309,400 |

| Random Samples | 272 | 25 | $ 350,205 |

| Random Samples | 1,837 | 112 | $ 465,999 |

| Recollection | 14,069 | - | $ 6,331,050 |

| Random Samples | 610 | 13 | $ 275,110 |

| Random Samples | 373 | 15 | $ 2,454,887 |

| Random Samples | 1,064 | 15 | $ 189,037 |

| Random Samples | 373 | 15 | $ 1,470,863 |

| Random Samples | 4,740 | 50 | $ 5,852,668 |

| Random Samples | 14,185 | 50 | $ 3,160,702 |

| Random Samples | 903 | 20 | $ 1,335,898 |

| Random Samples | 2,564 | 27 | $ 1,357,353 |

| Random Samples | 2,138 | 25 | $ 438,033 |

| Random Samples | 690 | 15 | $ 27,747 |

| Random Samples | 682 | 15 | $ 4,862,705 |

| Random Samples | 1,466 | 17 | $ 1,704,009 |

| Random Samples | 1,584 | 17 | $ 7,445,825 |

| Random Samples | 484 | 15 | $ 1,013,012 |

| Random Samples | 245 | 20 | $ 312,926 |

* Each Stratum has not been described so as not to identify the Museum.

This can further be refined by minimising the uncertainty (statistically maximising the precision) of the overall valuation. Statistical theory shows that for a stratified random sample, the uncertainty around the overall valuation is minimised by making the stratum sample sizes proportional to:

1. The number of items in the stratum;

2. The standard deviation of the values in the stratum;

3. The inverse of the square root of the cost per item within a stratum.

Items with high price variance must be excluded because their inclusion leads to the entire class being selected (sample size = number of items). High price items need to be added separately to obtain the actual total sample size.

Attachment C

Example of a formula to determine Relative Standard Error for single staged sampling

Category Level Estimates

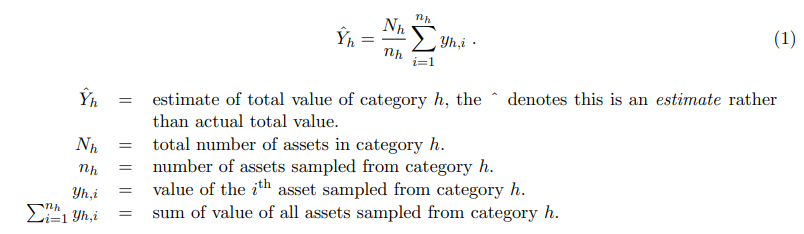

Within each category number raised estimation is employed. This estimation technique works by summing up the sample values and inflating (or weighting) this by a factor equal to the reciprocal of the sampling fraction. The following formula is used to estimate total value for each category:

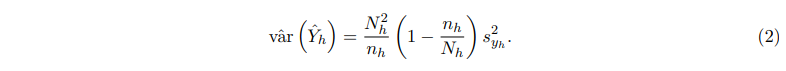

The precision of the estimate (1) can be quantified by a number of related measures: variance, standard error and relative standard error. The variance of the estimate is estimated by:

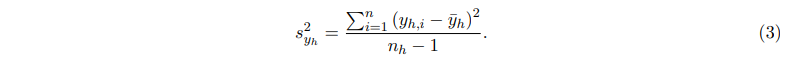

Because we do not know the true variability of the assets in each category, this formula is an estimate of the true variance of the estimate and is denoted with a ˆ. s2yh is the square of the sample standard deviation and is given by the following formula:

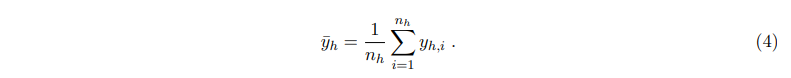

This formula uses y¯h, which is the sample mean of value for category h, calculated simply by summing the sample values in each category and dividing by the category sample size:

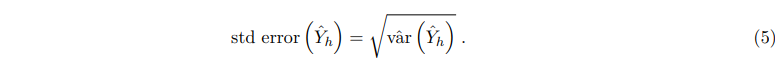

The standard error of the estimate is simply the square root of the variance of the estimate:

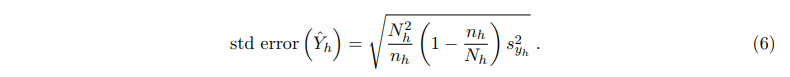

This can be combined with (2) to give:

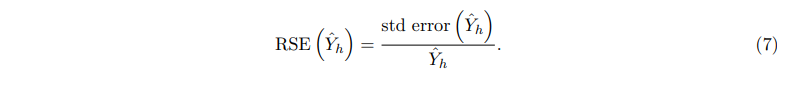

The relative standard error (or RSE) of the estimate is the ratio of the standard error to the estimate. The formula for the RSE is given by:

Total Level Estimates

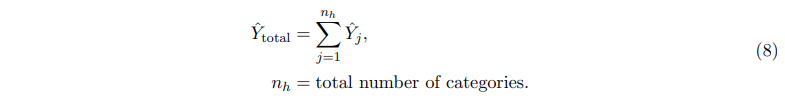

Estimates of total value (and subtotal values) can be derived from the category level estimates. The total value of all categories can be calculated by summing the category level estimates.

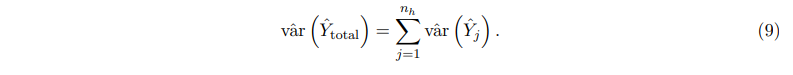

The estimate of variance of this total estimate is the sum of the category level estimates of variance:

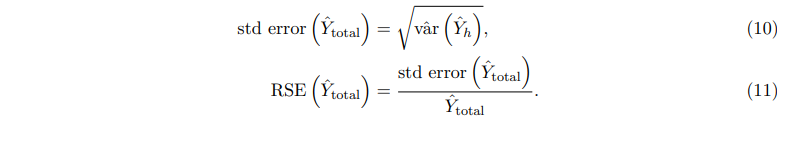

Once the variance has been calculated, the standard error and relative standard error can be calculated as above.

Attachment D

Financial Reporting disclosure considerations

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Basis of Preparation

Additional wording:

“The financial statements are prepared on an historical cost basis, except for property, plant and equipment which are measured at fair value.”

Revaluation of Property Plant and Equipment

Additional wording:

“Collection assets are revalued at least every five years by an external valuer with reference to the ‘Australian framework for the valuation of public sector collections for general purpose financial reporting’ “. The last revaluation was as at 30 June 20xx (or description of ‘rolling’ valuation basis, if applicable).

2. Collection categories:

- Highly Significant and Sensitive Collection Assets - description of type of items, number of items, valuation method, valuation details, total value;

- High Value Collection Assets - description of type of items, number of items, valuation method (generally market value based on professional valuations), valuation details, total value, threshold for classification as ‘High Value’, basis of determining threshold;

- General Collection Assets - description of type of items, number of items, valuation method (generally replacement cost as proxy for fair value) valuation details, total value;

- Uncatalogued Objects (organised) - description of type of items, number of items, valuation method (generally replacement cost as proxy for fair value but applied using stratified random sampling techniques), valuation details;

- Uncatalogued Objects (unorganised) - description of type of items, estimated number of items, explanation why not organised.

3. Valuation information

- Valuation cycle information - years in which particular assets have been subject to full independent valuation and program for future valuations

- Adjustments to valuation amounts between valuations and basis thereof

- With regard to valuations conducted during the current year:

- Name and qualifications of Valuer(s)

- The effective date of the valuation

- Location of items inspected

- Whether or not assets were physically inspected - if so, date(s) of inspection

- The valuation technique (including whether more than one valuation technique was used, and justification for the technique chosen) and details of the calculations

- All significant judgements, estimates and assumptions used by the Valuer and supported by a valid reasoning for their use. For instance, if the value of Collection Assets valued using the market approach is adjusted then the basis, reasoning and appropriateness of the adjustment should be disclosed

- The Fair Value hierarchy applied and, where relevant, reconciliations between hierarchies

- For valuations undertaken using a cost approach - the gross replacement cost and new Fair Value carrying amount

- Other relevant information regarding how the valuation was conducted and how the Fair Values were determined.

4. Sampling information

- Total population of items subject to sampling in each classification

- Sample size

- Relative Standard Error achieved

5. Acquisitions and disposals/deaccessions

- Amount of acquisitions by classification

- Book value of disposals/deaccessions, proceeds and adjustment to income

- Descriptions of significant items disposed of or deaccessioned